Anchor Your Wealth,

Embrace the Steady.

Stability and Income Generation with FDs & Bonds

At Artham FinoMetry, we understand the importance of stability and security in your investment portfolio. Fixed income investments, such as Fixed Deposits (FDs) and Bonds, provide a reliable and predictable source of income. Whether you are planning for retirement, saving for a major purchase, or seeking to preserve your wealth, our fixed income solutions offer a safe and steady growth path aligned with your investment milestones.

Is Fixed Income Right for You?

Conservative Investors

If your priority is capital preservation and generating steady income, Fixed Deposits and Bonds are ideal. They provide predictable income with minimal volatility, making them suitable for those who prefer safety over high returns.

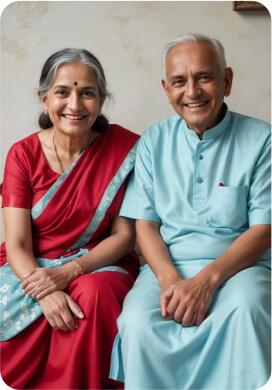

Retirees

For those looking to secure post-retirement expenses, FDs and Bonds offer regular interest payouts, ensuring a stable income. These instruments help retirees avoid market volatility while focusing on capital protection.

Short-term Milestone Planners

Whether you're saving for a major purchase, funding education, or building an emergency fund, Fixed Deposits and Bonds offer the required safety and stability for short-term investment milestones.

Institutional Investors

Businesses and institutions seeking stable investment options can benefit from FDs and Bonds. These instruments provide assured returns and help efficiently manage cash flow, making them a reliable choice for organizational investments.The Advantages of Fixed Income Investments

Stability and Security

Regular Income

Capital Preservation

Fixed Tenure and Returns

Types of Fixed Income Investments

-

Corporate Fixed Deposits (FDs)

Offered by non-banking financial institutions, FDs come with various tenures and interest rates. You can choose between short-term and long-term deposits, depending on your investment milestones. FDs offer cumulative and non-cumulative interest payout options to suit different investor needs. -

Government Bonds

Issued by the government, these bonds are considered one of the safest investment options. They provide fixed interest payments and are suitable for long-term conservative investments. A Demat account is mandatory for holding government bonds. -

Corporate Bonds

Issued by corporations, these bonds typically offer higher interest rates compared to government bonds but come with a slightly higher risk. Corporate bonds are ideal for investors seeking slightly better returns while maintaining a low-risk profile. A Demat account is mandatory for holding corporate bonds.

Take the Next Step

Transform your investment journey with Artham FinoMetry's expert guidance on Fixed Deposits and Bonds. Start Your Investment Journey